This page provides a high-level overview of annual renewal deadlines across U.S. jurisdictions. Because states regulate charitable solicitation independently, due dates and filing triggers vary significantly.

This information is intended as a planning reference. Organizations should confirm current requirements with the appropriate state agency before filing.

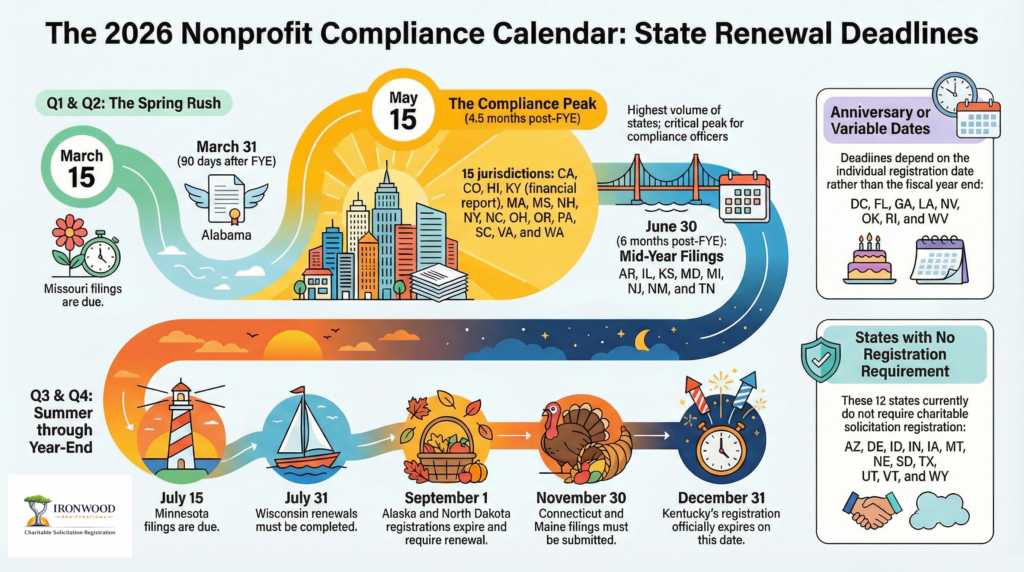

Visual Overview of State Renewal Deadlines

The chart below summarizes common charitable solicitation renewal timing patterns across U.S. jurisdictions. Because deadlines vary between fiscal-year and anniversary-based systems, organizations fundraising nationally often manage multiple compliance cycles simultaneously. This chart is focused on December year end organization, which comprise most, but not all nonprofits in the U.S.

The visual summary below highlights common charitable solicitation renewal timing patterns across U.S. jurisdictions and helps organizations anticipate peak compliance periods.

What This Timeline Helps Organizations Plan

- When most renewals cluster during the year

- Which states drive peak compliance workload

- How fiscal year end affects filing timing

- Why multi-state nonprofits often manage overlapping deadlines

Typical annual charitable solicitation renewal timing patterns across U.S. jurisdictions.

Download or share this graphic

This infographic may be shared for educational purposes with attribution to Ironwood Registrations.

Annual Renewal & Financial Reporting Deadlines

States use several different timing models:

- Fiscal year end–based (most common)

- Anniversary-based

- Fixed calendar deadlines

For financial reporting thresholds that often determine renewal requirements, see our State Audit and Review Threshold Guide.

| State | Renewal Due Date | Extension Availability | Notes |

| Alabama | 90 days after fiscal year end | Up to 180 days | Annual financial report required |

| Alaska | September 1 | Not available | Fixed date |

| Arkansas | ~6 months after fiscal year end | Available | Annual financial reporting required |

| California | ~4½ months after fiscal year end | Extension tied to IRS | |

| Colorado | ~4½ months after fiscal year end | IRS-based extension | |

| Connecticut | ~11 months after fiscal year end | Not available | |

| District of Columbia | Biennial — anniversary cycle | Limited | Based on license period |

| Florida | ~4½ months after fiscal year end | Available | |

| Georgia | ~4½ months after fiscal year end | Available | |

| Hawaii | ~4½ months after fiscal year end | Available | |

| Illinois | ~6 months after fiscal year end | Available | |

| Indiana | ~4½ months after fiscal year end | Available | |

| Iowa | ~4½ months after fiscal year end | Available | |

| Kansas | ~6 months after fiscal year end | Available | |

| Kentucky | ~4½ months after fiscal year end | Available | |

| Louisiana | Anniversary of filing | Available | |

| Maine | ~4½ months after fiscal year end | Available | |

| Maryland | ~6 months after fiscal year end | Available | |

| Massachusetts | ~4½ months after fiscal year end | Available | |

| Michigan | ~6 months after fiscal year end | Available | |

| Minnesota | ~4½ months after fiscal year end | Available | |

| Mississippi | ~4½ months after fiscal year end | Available | |

| Missouri | ~2½ months after fiscal year end | Available | |

| Nevada | Anniversary month of registration | Not available | Anniversary-based |

| New Hampshire | ~4½ months after fiscal year end | Available | |

| New Jersey | ~6 months after fiscal year end | Available | |

| New Mexico | ~4½ months after fiscal year end | Available | |

| New York | ~4½ months after fiscal year end | 6-month extension | Financial report required |

| North Carolina | ~4½ months after fiscal year end | Available | |

| North Dakota | September 1 | Extension available | |

| Ohio | ~4½ months after fiscal year end | IRS-based | |

| Oklahoma | ~4½ months after fiscal year end | Available | |

| Oregon | ~4½ months after fiscal year end | Available | |

| Pennsylvania | ~135 days after fiscal year end | Available | |

| Rhode Island | ~4½ months after fiscal year end | Available | |

| South Carolina | ~4½ months after fiscal year end | Limited | |

| Tennessee | ~6 months after fiscal year end | ||

| Vermont | ~6 months after fiscal year end | Available | |

| Virginia | ~4½ months after fiscal year end | Available | |

| Washington | ~4½ months after fiscal year end | Available | |

| West Virginia | ~4½ months after fiscal year end | Available | |

| Wisconsin | ~6 months after fiscal year end | Available |

(States that do not require charitable solicitation registration are omitted from renewal tracking.)Initial Registration Timing by State

This table summarizes when registration is typically required relative to fundraising activity.

Planning Note

Because deadlines vary by fiscal year end, anniversary date, and extension status, organizations operating in multiple states typically maintain a centralized renewal calendar and documentation repository.

Organizations that prefer not to manage this process internally often work with compliance specialists such as Ironwood Registrations to coordinate renewals and track deadlines across jurisdictions.

Managing renewal timelines across multiple states can become complex as organizations grow.

Many organizations discover that tracking renewal cycles across multiple jurisdictions becomes the primary operational compliance risk as fundraising expands.

Schedule a consultation to review your registration calendar.

Share or Embed This Compliance Calendar

This infographic may be shared for educational purposes with attribution to Ironwood Registrations.

<a href=”https://www.ironwoodregistrations.com/resources/charitable-solicitation-renewal-deadlines/”>

<img src=”https://www.ironwoodregistrations.com/wp-content/uploads/2026/02/Filing-Timelines-1-scaled.png” alt=”Nonprofit Renewal Deadlines Infographic”></a>

Disclaimer: This page is provided for general informational purposes only and does not constitute legal advice. Requirements and due dates change periodically.