Last Updated: February 2026

Financial statement requirements associated with charitable solicitation registrations vary widely among states and are frequently tied to contribution levels, gross revenue, or organizational expenses. Depending on the jurisdiction, nonprofits may be required to submit audited financial statements, independent reviews, compilations, or rely on IRS Form 990 filings to satisfy annual reporting obligations. For organizations fundraising across multiple states, understanding these thresholds is important for planning audit timing, coordinating with accounting firms, and ensuring consistent compliance. The summary below outlines common audit and financial reporting thresholds used by states regulating charitable solicitations. Organizations fundraising nationally often plan financial statement preparation around the most restrictive state requirement to avoid delays during renewal season.

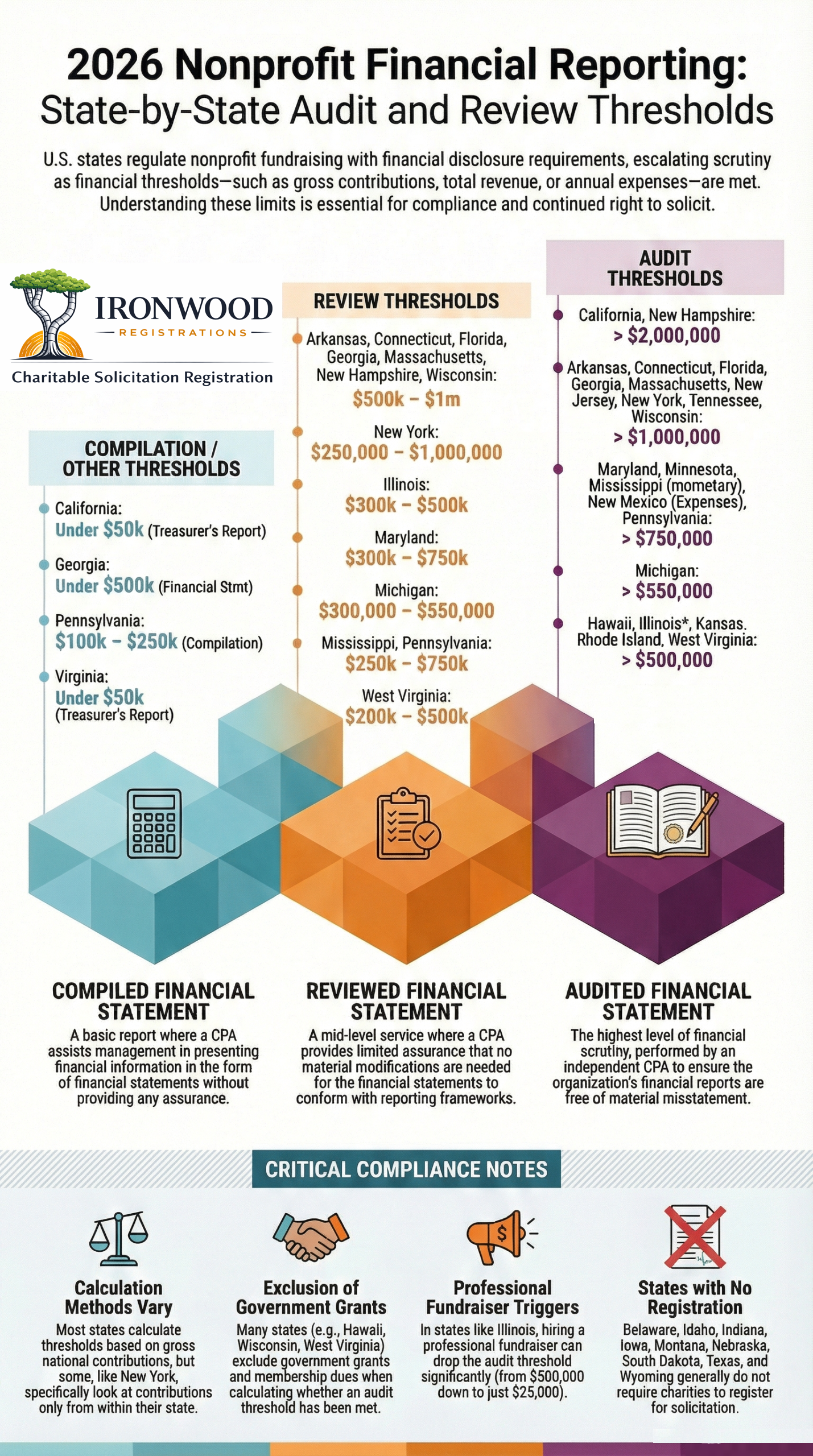

Visual Summary of State Audit Thresholds

The chart below summarizes common audit and financial review thresholds used by states regulating charitable solicitation registrations. Because requirements vary by revenue definitions and exclusions, organizations fundraising nationally should review individual state rules alongside this overview. Specific state rules are listed below the graphic.

This infographic may be shared for educational purposes with attribution to Ironwood Registrations.

The following states impose specific audit, review, or financial reporting thresholds tied to charitable solicitation registration renewals and initial filings.

States With Specific Audit or Review Thresholds

| State | Basis for Threshold | Financial Statement Requirement |

|---|---|---|

| Arkansas | Contributions | Audit: Contributions > $1,000,000 Review: Contributions $500,000 – $1,000,000 |

| California | Gross Revenue | Audit: Gross Revenue > $2,000,000 (Exclude government grants if accounting provided) |

| Connecticut | Gross Revenue | Audit: Gross Revenue > $1,000,000 Review: Gross Revenue $500,000 – $1,000,000 (Exclude government grants/fees) |

| Florida | Contributions | Audit: Contributions > $1,000,000 Review: Contributions $500,000 – $1,000,000 (Neither required if CPA signed the Form 990) |

| Georgia | Revenue | Audit: Revenue > $1,000,000 Review: Revenue $500,000 – $1,000,000 Financial Statement: Revenue < $500,000 |

| Hawaii | Gross Revenue | Audit: Gross Revenue > $500,000 (excluding gov. grants) OR if required by a governmental authority or third party. |

| Illinois | Contributions | Audit: Contributions > $500,000 (Threshold drops to $25,000 if professional fundraiser used) Review: Contributions $300,000 – $500,000 |

| Kansas | Contributions | Audit: Contributions > $500,000 |

| Maryland | Contributions | Audit: Contributions > $750,000 Review: Contributions $300,000 – $750,000 (Exclude government grants) |

| Massachusetts | Revenue | Audit: Revenue > $1,000,000 Review: Revenue $500,000 – $1,000,000 |

| Michigan | Contributions | Audit: Contributions > $550,000 Review: Contributions $300,000 – $550,000 (Exclude government grants; include net income from special events) |

| Minnesota | Total Revenue | Audit: Total Revenue > $750,000 |

| Mississippi | Monetary Donations | Audit: Contributions > $750,000 Review: Contributions $250,000 – $750,000 (Entities receiving only nonmonetary donations are exempt from audit) |

| New Hampshire | Revenue | Audit: Revenue > $2,000,000 GAAP Financials: Revenue $500,000 – $2,000,000 |

| New Jersey | Gross Revenue | Audit: Gross Revenue > $1,000,000 (Exclude in-kind contributions) |

| New Mexico | Total Expenses | Audit: Total Annual Expenses > $750,000 |

| New York | Gross Revenue | Audit: Gross Revenue > $1,000,000 Review: Gross Revenue $250,000 – $1,000,000 |

| Pennsylvania | Gross National Contributions | Audit: Contributions > $750,000 Review: Contributions $250,000 – $750,000 Compilation: Contributions $100,000 – $250,000 (Exclude government grants/contracts and membership dues) |

| Rhode Island | Gross Revenue | Audit: Gross Revenue > $500,000 |

| Tennessee | Gross Revenue | Audit: Gross Revenue > $1,000,000 (Exclude government and foundation grants) |

| Virginia | N/A | Audit or 990: Certified audited financial statements are accepted in lieu of the IRS Form 990. If income is < $50,000, a certified treasurer’s report is accepted. |

| West Virginia | Contributions | Audit: Contributions > $500,000 Review: Contributions $200,000 – $500,000 (Exclude government and private foundation grants) |

| Wisconsin | Contributions | Audit: Contributions ≥ $1,000,000 Review: Contributions $500,000 – $1,000,000 (Exclude government grants and membership dues; Review only required if not filing IRS Form 990) |

States with No Audit Requirement or Accepting IRS Form 990

The following states require registration but generally allow the submission of the IRS Form 990 in lieu of a specific state-mandated audit, or no specific dollar threshold for an audit is listed in their solicitation laws:

• Alabama: Allows audited financial statement or self-created report.

• Alaska: No annual financial report required.

• Colorado: State’s annual financial report corresponds to IRS Form 990.

• District of Columbia: Annual financial report not required.

• Kentucky: Accepts IRS Form 990.

• Maine: Accepts IRS Form 990 or budget.

• Missouri: Requires annual report or URS. 501(c)(3) organizations are typically exempt from filing.

• Nevada: Annual financial report not required.

• North Carolina: Accepts IRS Form 990, audited financials, or Annual Financial Report Form.

• North Dakota: Accepts IRS Form 990 or financial statements.

• Ohio: No financial statements required.

• Oklahoma: No financial statements required.

• Oregon: Audited financial statements not required if not prepared.

• South Carolina: Only required IRS Form 990.

• Washington: Financial Statements not required

States with No Charitable Solicitation Registration

These jurisdictions do not generally require charitable solicitation registration, though other nonprofit or business filings may still apply.:

• Delaware

• Idaho

• Indiana

• Iowa

• Montana

• Nebraska

• South Dakota

• Texas (Except for law enforcement/veterans/public safety)

• Utah

• Vermont (Only paid fundraisers register)

• Wyoming

Managing Multi-State Financial Statement Requirements

Nonprofits fundraising across multiple states often discover that financial reporting obligations are determined by the most restrictive state in which they are registered. As contribution levels grow, coordinating audit timing, reviews, and renewal filings across different state requirements can become increasingly complex. Many nonprofits adopt a coordinated approach to multi-state charitable solicitation compliance to ensure financial statements align with renewal schedules and filing deadlines. Structured oversight can also simplify annual registration renewals and reduce the risk of missed or inconsistent submissions.

About This Resource

This resource was prepared by Ironwood Registrations, a consulting firm focused exclusively on multi-state charitable solicitation registration and compliance management.

Our work involves coordinating annual filings, financial statement requirements, and renewal obligations across multiple jurisdictions for nonprofit organizations fundraising nationally. Content is periodically reviewed and updated to reflect current state reporting practices.

Frequently Asked Questions About Charitable Solicitation Audit Requirements

When is an audit required for charitable solicitation registration?

Many states require audited financial statements once a nonprofit exceeds specific contribution, revenue, or expense thresholds. These limits commonly range from $500,000 to $2,000,000 depending on the state and how financial activity is calculated. Requirements apply to annual charitable solicitation renewals rather than IRS filings alone.

Do all states require audited financial statements?

No. Some states accept the IRS Form 990 or internally prepared financial information instead of an audit. Requirements vary widely, and several jurisdictions do not impose a specific audit threshold under their solicitation laws.

What is the difference between an audit and a financial review?

An audit provides the highest level of independent assurance and includes detailed testing by a CPA firm. A financial review involves analytical procedures and limited inquiry but does not include full verification testing. Many states require a review at mid-level revenue thresholds before an audit becomes mandatory.

How do nonprofits handle different requirements across multiple states?

Organizations fundraising nationally often prepare financial statements that meet the most restrictive state requirement. Coordinating audit timing with renewal deadlines helps ensure filings remain consistent across jurisdictions and prevents delays or deficiencies.

Can an IRS Form 990 satisfy state financial reporting requirements?

In some states, the IRS Form 990 may be accepted in place of audited financial statements, particularly for smaller organizations. However, once certain thresholds are exceeded, states may require independently prepared financial statements regardless of federal filing status.

Planning to Register in Multiple States?

Organizations registering nationwide often prepare audited financial statements based on the most restrictive state requirements. Coordinated compliance planning helps reduce delays, duplicate work, and renewal risk.

Learn More About Multi-State Compliance